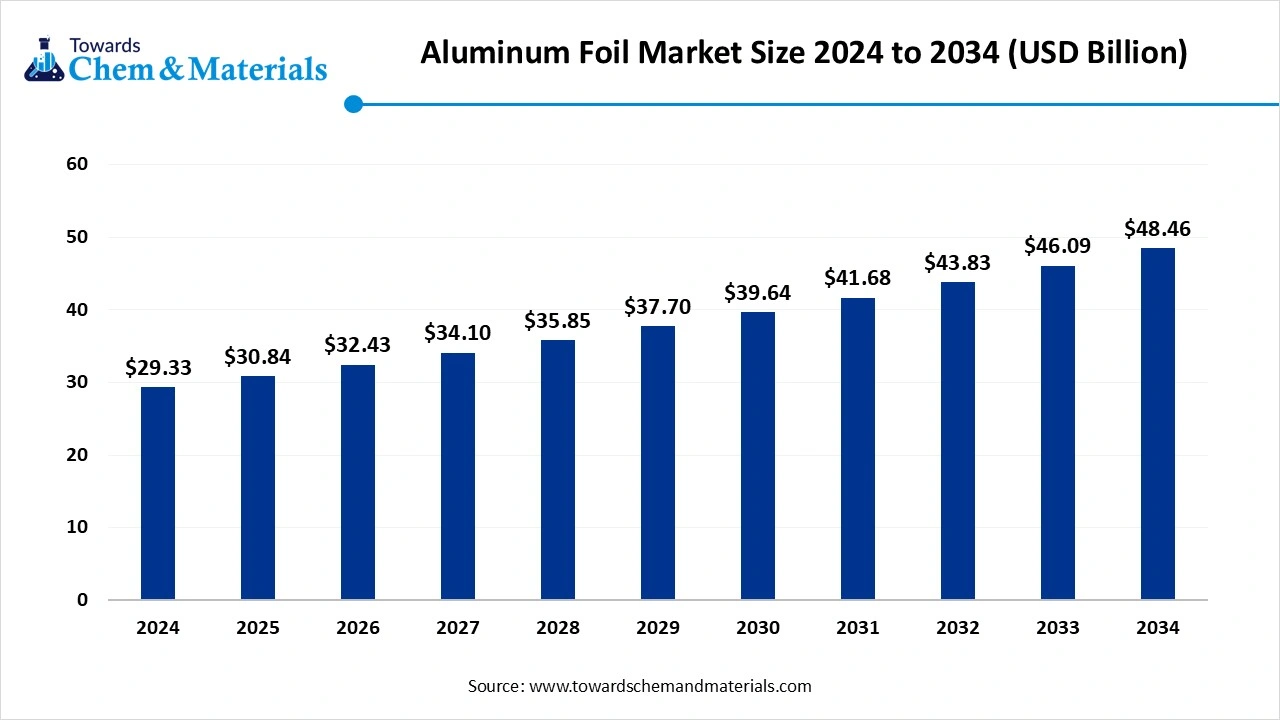

Aluminum Foil Market Size to Worth USD 48.46 Billion by 2034

According to Towards Chemical and Materials, the global aluminum foil market size was reached at USD 29.33 billion in 2024 and is expected to be worth around USD 48.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034.

Ottawa, Sept. 24, 2025 (GLOBE NEWSWIRE) -- The global aluminum foil market size is valued at USD 30.84 billion in 2025 and is anticipated to reach around USD 48.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The growth of the market is driven by the rising demand for convenient and sustainable food packaging solutions is driving the growth of the demand of the aluminum foil market.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5779

Aluminum Foil Market Report Highlights

- The Asia Pacific aluminum foil market size was estimated at USD 12.32 billion in 2024 and is anticipated to reach USD 20.74 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034. Asia Pacific dominated the aluminum foil market in 2024,

- By region, Asia Pacific dominated the market in 2024. The Asia-Pacific region held a 42% share in the market in 2024. The growth is driven by the increased demand from the packaging industry.

- By product type, the wrapper foil (packaging) segment dominated the market in 2024. The wrapper foil (packaging) segment held a 35% share in the market in 2024. The properties offered fuel the growth of the market.

- By thickness, the 0.007 mm – 0.09 mm (packaging grade) segment dominated the market in 2024. The 0.007 mm – 0.09 mm (packaging grade) segment held a 55% share in the market in 2024. Increasing demand for sustainable and recyclable materials drives growth.

- By application, the food & beverage packaging segment dominated the market in 2024. The food & beverage packaging segment held a 45% share in the market in 2024. The expanding use of packaged food fuels the growth.

- By end use, the food & beverage segment dominated the market in 2024. The food & beverage segment held a 47% share in the market in 2024. The rising demand for safety and sustainable packaging increases the growth.

- By distribution channel, the direct sales to the converters segment dominated the market in 2024. The high-strength segment held a 60% share in the market in 2024. The demand from large-scale industry fuels the growth.

Aluminum foil market Overview

Aluminium foil packaging is increasingly preferred across food, pharmaceuticals, and personal care industries because it offers excellent barrier protection against moisture, oxygen, light and contaminants, helping preserve freshness and quality. Key market drivers include rising consumer demand for sustainable and lightweight packaging, growth in e-commerce and ready to eat food items, and stricter regulations around packaging materials. Asia pacific is a major hub for both production and consumption, leveraging expanding food and beverage and healthcare sectors.

Innovation is evident in the adoption of recyclable foils., thinner gauges that reduce material use while maintaining performance, and advanced packaging formats like pouches, containers, and wraps that cater to convince and portability. Challenges remain around environmental concerns, specially disposable and recycling of soiled foil, and fluctuating raw material and energy costs that affect profitability. Overall, the market is shifting toward greener, more efficient foil packaging solutions, with manufacturers investing in both technological improvement and regulatory compliance to meet evolving customer expectations.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5779

Aluminum Foil Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 30.84 Billion |

| Revenue forecast in 2034 | USD 48.46 Billion |

| Growth rate | CAGR of 5.15% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2020 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative Units | Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Thickness, By Application, By End-Use Industry, By Distribution Channel, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key companies profiled | ACM Carcano; Amcor; Assan Aluminyum; Ess Dee Aluminium; Eurofoil; Hindalco Industries Limited; Huawei Aluminium; Laminazione Sottile; Shanghai Metal Corporation; UACJ Foil Corporation; Xiamen Xiashun Aluminium Foil Co., Ltd; Zhejiang Junma Aluminum Industry |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Aluminium foil Market Trends

- Growing preference for sustainable and recyclable packaging materials, with a shift away from plastics toward aluminium foil because of its barrier properties and recyclability.

- Innovation in product formats, such as spouted pouches, recyclable laminates, and ultra-thin foils, to meet demands for convenience, performance, and environmental friendliness.

- Rising use of aluminium foil in electronics and energy applications, specially as demand for EV batteries and electronic components increases.

- Increased role of e-commerce and food delivery in driving demand for packaging foil, due to growth in ready to evolve food and convenience-oriented consumption.

- Enhanced focus on supply chain, cost optimization, and environmental regulations, including improving recycling techniques, reducing raw material volatility, and adopting eco-friendly production method.

Aluminium Foil Market Growth Factors

Can Trade Measures Help Producers Win Big?

One growth factor is the imposition of anti-dumping duties by governments to protect domestic aluminium foil manufacturers. For example, India recently extended anti-dumping duties on aluminium foil imports from China, Taiwan, and Russia, aiming to curb imports sold below fair value and support its local foil industry. This kind of protectionism tends to raise local production, encourage investment in domestic capacity, and reduce overreliance on cheaper imports, boosting overall market growth.

Is Flexible Packaging The Unsung Hero Of Demand?

Another key growth factor is the strong rise in demand for flexible, thinner aluminium foils, particularly for food packaging the household use. In Europe, deliveries of thinner foil that are used in flexible packaging and domestic foil applications rose much faster than thicker foil in early 2025, reflecting consumer preference for lightweight, easy to handle packaging. This shift toward flexible foil increases market volume, spurs innovation, and opens up growth in downstream packaging sectors.

Market Opportunity

Can Low Carbon Aluminium Be The Game Changer For Brand Trust?

One opportunity lies in producing and marketing low carbon aluminium foil. Companies like Constantia Flexibles are offering foil made with significantly reduced CO2, emissions, positioning it as a high performance but more environmentally responsible option. For brands, using this kind of foil offers a way to align with sustainability goals, reduced carbon footprints, and appeal to eco conscious consumers all while maintaining quality.

Will Stricter EPR Rules Push Foil Into Spotlight?

Extended Producer Responsibility (EPR) and new regulatory pressure on packaging waste are creating opening for aluminium foil as a more recyclable packaging material. There is growing industry demand for mono material packaging (or packaging with fewer mixed materials) to improve recyclability. Aluminium foil, specially clean foil used in recyclable formats, can benefit because it already has strong recycling credentials and can replace formats, can benefit because it already has strong recycling credentials and can replace less recyclable plastics in many applications. This shift is an opportunity for foil producers to innovate packaging design, traceability, and to supply to companies needing compliant, sustainable packaging.

Limitations In the Aluminium foil market

- The market faces significant raw material price volatility, which increases production costs and squeezes profit margins.

- Recycling challenges and environmental concerns specially around disposing of contaminated foil and assuring sustainable production remain a hurdle to wider adoption.

Which Region Is Shaping the Aluminium Foil Markets Trajectory Asia Pacific?

Asia Pacific accounted for a considerable share of the market in 2024, and production, driven by rapidly urbanizing populations, growing urban middle classes, and expanding industrial and food packaging sectors. Demand for packaged and processed foods, convenience meals, and pharmaceutical usage is rising, creating consistent demand for high quality foil, specially in countries with expanding retail infrastructure. Local production is increasing to meet regional demand, taking advantage of competitive raw material costs, large labour forces, and economies of scale. Moreover, export activity from Asia Pacific remains strong, as many manufacturers in countries like India, China, and southeast Asia supply both regional and global markets. All this positions Asia Pacific not merely as a large volume player but as a major growth engine for the global aluminium foil industry.

China accounts for a large share of both consumption and production of aluminium foil within Asia Pacific, outpacing many other countries by a substantial margin. Its domestic demand is fuelled by its massive food packaging, pharmaceutical, and industrial electronics sectors, requiring foil across many applications. Production capacity in China has scaled up considerably, benefiting from lower input costs and large scale operations which provide manufacturing efficiencies. Exports are meaningful, often supplying market abroad, while local demand continues to surge due to shifts in consumer eating habits, growth in e-commerce and food delivery, and policies that increasingly favour upgraded packaging and sustainable materials.

Will Rising Incomes Spark Aluminium Foil Growth In The Middle East And Africa?

The middle and Africa region is expected to experience the highest growth rate in the market between 2025 and 3024, supported primarily by rising disposable incomes and changing consumer lifestyles. With expanding urban populations and a growing appetite for packaged and convenient food product\s, the demand for aluminium foil in food packaging and household applications in increasing steadily. Additionally, healthcare sector expansion and investments in modern retail infrastructure further contribute to foil adoption in pharmaceuticals and personal care packaging. As consumers in the positioned to capture strong opportunities for expansion.

Aluminum Foil Market Segmental Insights

Product Insights:

Why is wrapper foil so prominent in packaging?

The wrapper foil segment maintained a strong position in the market in 2024. This is largely due to its widespread use in food for beverage packaging, household applications, and consumer goods where freshness, convenience, and portability are essential. Wrapper foils provide an excellent barrier against moisture, oxygen, and contaminants, ensuring longer shelf life and better product safety. They are also versatile, used in everything from chocolates and snacks to frozen foods and ready to eat meals. The rise of on the go lifestyles and the expansion of retail and e0commerce platforms have strengthened demand for this type of foil, making it central product in the overall market structure.

The blister foil segment is projected to grow at the fastest pace during the forecast period. This expansion is closely linked to the increasing demand in the pharmaceutical industry for safe, reliable, and tamper evident packaging solutions. Blister foils protect sensitive medicines from light, moisture, an d external contamination, which is essential for maintaining drug stability and effectiveness. With rising healthcare needs, gaining populations, and greater emphasis on affordable medical distribution, blister packaging continues to gain traction. Furthermore, the push toward personalized medicine and small batch production further supports the adoption of blister foils, as they allow flexible yet secure packaging for diverse pharmaceutical products.

Thickness Insights:

Why Does Packaging Grade Foil Dominate Use?

The 0.007mm-0.09 mm packaging grade segment accounted for a considerable share of the market In 2024. This thickness range is highly favoured because it provides the right balance between material efficiency, flexibility, and strength, making it suitable for everyday food, beverage, and household packaging. Its adaptability allows it to be used in pouches, containers, and wraps that meet modern consumer needs for lightweight, protective, and cost effective packaging. This grade is particularly important in regions with high packaged food consumption, as it helps ensure product safety while reducing excess material usage.

The >0.2 mm (EV and specialty industrial) segment is anticipated to grow with the highest CAGR in the market during the studied years. Heavy gauge foils are used in energy storage, heat exchangers, and advanced electronics where durability and conductivity are essential. The accelerating adoption of electric mobility and renewable energy technologies creates strong opportunities for this thickness segment. As manufacturers continue to innovate in battery technology and energy systems, the demand for thicker foil is poised to increase, underscoring its role in powering industrial and technological growth.

Application Insights:

Why Does Food And Beverage Packaging Hold Such Importance?

The food and beverage packaging segment dominated the aluminium foil market in 2024. This dominance stems from its critical role in preserving freshness, extending shelf life, and ensuring hygiene in both fresh and processed foods. The segment has benefited from rising consumer preferences for convince, ready to eat meals, and products with longer storage capacity. Aluminium foil packaging not only safeguard taste and quality but also meets the growing need for lightweight portable packaging formats. With supermarkets, hypermarkets, and online food delivery services flourishing, this segment has established itself as the backbone of aluminium foil consumption.

The food and beverage segment enjoyed a prominent position in the market during 2024. Aluminium foil plays a crucial role as current collector in lithium-ion batteries, making it indispensable for EVs and renewable energy storage systems. As global industries shift toward electrification, the use of foil in these applications is expanding rapidly. The combination of conductivity, lightweight properties, and corrosion resistance makes aluminium foil an ideal material to support the future of energy technology, positioning this segment as a critical growth frontier.

End Use Insights:

Why Does Food And Beverage Remain At The Core?

The food and beverage sector had a prominent position in the market during 2024. This is because aluminium foil has long been recognized as one of the most effective materials for maintaining food quality, freshness, and flavour. It is used across packaging for dairy, confectionery, baked goods, beverages, and ready meals. Changing lifestyles, rising disposable incomes, and the expansion of organized retail continue to strengthen demand for aluminium foil in this sector. Additionally, it recyclability aligns with increasing sustainability gaols, making it even more attractive to brands and consumers alike.

The pharmaceuticals and healthcare segment will gain a significant share of the market over the studied period of 2025 to 2034. Aluminium foil is indispensable for secure, tamper proof, and sterile packaging of medicines, from tablets to syringes. The sector’s growth is being propelled by rising healthcare spending, a focus on affordable medicine distribution, and global efforts to strengthen medical supply chains. The ability of foil to meet strict regulatory requirements and its effectiveness in protecting product integrity positions it as a vital enabler of growth in the healthcare industry.

Distribution channel insights:

Why Are Convertors Crucial For Sales?

Direct sales to converters captures a significant portion of the market in 2024. Converters are key players in transforming raw aluminium foil into finished packaging products like p[ouches, wraps, and laminates. Direct sales ensure better supply chain coordination, cost efficient, and consistency in quality, which are essential for industries that require large volumes of customized foil. The strong relationship between foil manufacturers and converters underpins this segment’s importance in maintaining market stability and ensuring timely delivery to downstream industries.

The online B2B platforms segment is predicted to witness significant growth in the market over the forecast period. The rise of digital marketplaces is reshaping how businesses procure raw materials and packaging products. For aluminium foil producers, online channels create opportunities to reach new clients, streamline transactions, and expand into regions where physical distribution is less developed. With companies increasingly adopting digital procurement practices, the online B2B space is emerging as a flexible and scalable channel that will support future growth in the aluminium foil market.

More Insights in Towards Chemical and Materials:

- Copper Foil Market : The global copper foil market volume is calculated at 387.50 kilo tons in 2024, grew to USD 415.07 kilo tons in 2025 and is predicted to hit around 770.50 kilo tons by 2034, expanding at healthy CAGR of 7.11% between 2025 and 2034.

- Aluminum Composite Materials Market : The global aluminum composite materials market size is calculated at USD 3.84 billion in 2024, grew to USD 4.14 billion in 2025, and is projected to reach around USD 8.18 billion by 2034. The market is expanding at a CAGR of 7.85% between 2025 and 2034.

- Aluminum Trihydrate (ATH) Market : The global aluminum trihydrate (ATH) market volume was reached at 2850.21 kilo tons in 2024 and is expected to be worth around 4653.45 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 5.02% over the forecast period 2025 to 2034.

- Aluminum Oxide Market : The global aluminum oxide market volume was reached at 160.12 million tons in 2024 and is expected to be worth around 215.45 million tons by 2034, growing at a compound annual growth rate (CAGR) of 3.01% over the forecast period from 2025 to 2034.

- Bentonite Market : The global bentonite market size was estimated at USD 3.11 billion in 2024 and is expected to hit around USD 5.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.25% over the forecast period from 2025 to 2034.

- Formic Acid Market : The global formic acid Market is expected to reach a volume of approximately 999.88 thousand tons in 2024, with a forecasted increase to 1,551.30 thousand tons by 2034, growing at a CAGR of 4.49% from 2025 to 2034.

- Flame Retardant Chemicals Market : The global flame retardant chemicals market size was estimated at USD 7.85 billion in 2024 and is expected to hit around USD 13.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period from 2025 to 2034.

- Essential Oils Market : The global essential oils market size was valued at USD 26.11 billion in 2024, grew to USD 28.49 billion in 2025, and is expected to hit around USD 62.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.11% over the forecast period from 2025 to 2034.

-

Tile Adhesives Market : The global tile adhesives market size was valued at USD 3.65 billion in 2024, grew to USD 3.93 billion in 2025, and is expected to hit around USD 7.61 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.63% over the forecast period from 2025 to 2034.

Aluminum Foil Market Top Key Companies:

- ACM Carcano

- Amcor

- Assan Aluminyum

- Ess Dee Aluminium

- Eurofoil

- Hindalco Industries Limited

- Huawei Aluminium

- Laminazione Sottile

- Shanghai Metal Corporation

- UACJ Foil Corporation

- Xiamen Xiashun Aluminium Foil Co., Ltd

- Zhejiang Junma Aluminum Industry

Recent Developments

- In March 2025, Cosmo Specialty Chemicals a leading company announced the launch of the product COSEAL-601 heat seal coating solution. The launch aims to offer consumers the best-in-class sealing, which offers high and superior resistance to water and oil.

- In August 2025, A merger has just been announced between DI Dongil and Dongil Aluminium to improve production of battery grade aluminium foil. The combined entity plans to streamline its operations and eliminate duplicate role, and is also building a new plant focused entirely on foil for battery applications.

- In August 2025, Researchers in Oman have introduced a green synthesis method that repurposes old aluminium foil into aluminium oxide nanoparticles, providing a new outlet for waste foil. These nanoparticles are expected to be useful in sectors such as agriculture industry, and health care.

Aluminum Foil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Aluminum Foil Market

By Product Type

- Wrapper Foil

- Container Foil

- Blister Foil

- Foil Rolls (household, catering)

- Industrial Foil (HVAC, insulation, batteries)

By Thickness

- 0.007 mm – 0.09 mm (Packaging & Household)

- 0.09 mm – 0.2 mm (Containers & Industrial)

- 0.2 mm (Specialty Applications)

By Application

- Food & Beverage Packaging (dairy, bakery, confectionery, ready meals)

- Pharmaceuticals (blister packs, strip packs)

- Household Use (kitchen foil, wrapping)

- Industrial (HVAC insulation, construction, electronics, batteries)

- Tobacco Packaging

- Others (cosmetics, personal care, specialty uses)

By End-Use Industry

- Food & Beverage

- Pharmaceuticals & Healthcare

- Household & Consumer Goods

- Construction & Building Materials

- Electronics & Energy (EV batteries, capacitors)

- Tobacco Industry

By Distribution Channel

- Direct Sales to Converters & Manufacturers

- Packaging Distributors

- Retail (household foil rolls)

- Online B2B Platforms

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5779

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.