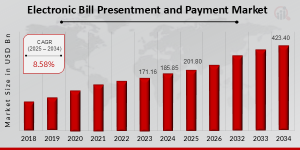

Electronic Bill Presentment and Payment Market to Grow at 8.58% CAGR, Reaching USD 423.40 Billion by 2034

According to MRFR, the EBPP market will grow from USD 201.80B in 2025 to USD 423.40B by 2034, with a CAGR of 8.58% during the forecast period.

TEXAS, TX, UNITED STATES, August 6, 2025 /EINPresswire.com/ -- According to a new report published by Market Research Future (MRFR), Electronic Bill Presentment and Payment Market is projected to grow from USD 201.80 Billion in 2025 to USD 423.40 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 8.58% during the forecast period 2025 - 2034.The EBPP market has emerged as a cornerstone in modern financial ecosystems, offering seamless digital solutions for bill delivery and payment processing. As businesses and consumers rapidly transition toward paperless environments, EBPP platforms facilitate real-time billing, enhanced user experience, reduced operational costs, and improved cash flow management. With the digital transformation of financial services, organizations across various industries—including utilities, telecom, healthcare, and BFSI—are increasingly adopting EBPP systems to optimize revenue cycles and offer customers secure, efficient, and convenient payment options. The global EBPP market has shown consistent growth, driven by technological advancements, increased internet penetration, and rising customer expectations for speed and transparency in billing processes.

Download Sample Report (Get Full Insights in PDF - 200 Pages) at:

https://www.marketresearchfuture.com/sample_request/26563

Market Key Players:

The EBPP market is highly competitive and includes a mix of established technology giants and innovative fintech startups. Leading players such as ACI Worldwide Inc., Fiserv Inc., Oracle Corporation, SAP SE, Mastercard, and PayPal Holdings Inc. dominate the landscape with comprehensive platforms and robust global reach. Additionally, companies like CSG International, Jack Henry & Associates, Bottomline Technologies, and Infosys have carved significant market shares by offering niche and tailored EBPP solutions. The competitive dynamic is further shaped by strategic collaborations, mergers and acquisitions, and continuous R&D investments aimed at expanding functionality, integrating AI and machine learning, and enhancing cybersecurity frameworks.

Market Segmentation:

The EBPP market is segmented based on deployment mode, channel, end-user, and geography. By deployment, the market is categorized into on-premise and cloud-based solutions, with cloud-based models gaining rapid traction due to scalability and cost-efficiency. In terms of channels, EBPP systems are accessed via web portals, mobile apps, email billing, and SMS-based links, catering to diverse user preferences. The end-user segmentation includes sectors like telecom, utilities, BFSI, government, healthcare, and retail, each leveraging EBPP to streamline payment collections and improve customer engagement. Geographically, the market spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with North America leading due to early adoption and advanced digital infrastructure.

Market Drivers:

Several key factors are propelling the EBPP market forward. The increasing consumer demand for convenient, digital-first payment methods is a primary driver, along with the global surge in mobile device usage and internet access. Businesses are also motivated by cost savings from reduced paper billing, improved customer service capabilities, and faster payment cycles enabled by EBPP platforms. Regulatory support for digital finance ecosystems and growing awareness of environmental sustainability through paperless transactions further encourage adoption. Moreover, the integration of artificial intelligence and analytics in EBPP systems is helping providers offer personalized billing experiences and predictive insights, enhancing customer satisfaction and operational efficiency.

Market Opportunities:

The EBPP market presents significant opportunities, particularly in emerging economies where digital payment infrastructure is still evolving. Financial inclusion initiatives and the proliferation of smartphones in these regions offer a vast, untapped customer base for EBPP providers. Additionally, the increasing adoption of subscription-based business models across industries is creating demand for recurring billing solutions, a key function of modern EBPP platforms. There is also potential in integrating EBPP with broader enterprise resource planning (ERP) systems, which can help businesses achieve holistic financial automation. As cybersecurity becomes a paramount concern, EBPP providers that offer secure, compliant, and resilient platforms are positioned to gain a competitive edge and foster trust among enterprises and end users alike.

Restraints and Challenges:

Despite its advantages, the EBPP market faces several challenges that could hinder its growth trajectory. Data security and privacy concerns remain significant, particularly in the face of rising cyber threats targeting financial platforms. Compliance with complex regulatory frameworks across different countries can also be burdensome for providers operating in multiple regions. Additionally, integration with legacy systems, especially in traditional industries, can be costly and time-consuming. Limited digital literacy among users in certain demographics and regions may also impact adoption rates. Furthermore, market fragmentation and varying standards across platforms pose interoperability issues, which can disrupt user experience and hinder seamless financial transactions.

Regional Analysis:

Regionally, North America holds the largest share of the EBPP market, driven by widespread adoption of digital payments, a tech-savvy population, and strong regulatory frameworks supporting e-billing practices. The U.S. remains a key contributor with advanced fintech infrastructure and early adoption of EBPP technologies across sectors. Europe follows closely, with countries like the UK, Germany, and France leading in terms of compliance-driven digitization and consumer preference for online bill payments. In Asia Pacific region, the market is witnessing exponential growth, especially in China and India, due to rapid urbanization, government-led digital initiatives, and the surge of mobile-first consumers. Latin America and the Middle East & Africa are gradually catching up, propelled by financial inclusion strategies and mobile banking penetration, albeit at a slower pace compared to other regions.

Browse a Full Report (Including Full TOC, List of Tables & Figures, Chart)-

https://www.marketresearchfuture.com/reports/electronic-bill-presentment-payment-market-26563

Recent Development:

The EBPP market has seen several noteworthy developments in recent years. Key players have been actively enhancing their platforms through AI integration, offering features like automated payment reminders, fraud detection, and real-time analytics. Strategic acquisitions—such as Fiserv’s acquisition of First Data—have strengthened market positions and broadened service offerings. Companies are also expanding their cloud capabilities, enabling SMEs and large enterprises to manage billing with greater flexibility and security. Regulatory shifts, like PSD2 in Europe and India’s RBI guidelines on digital transactions, are shaping how EBPP systems are designed and deployed. Moreover, partnerships between telecom providers, utility companies, and fintech firms are resulting in bundled solutions that make it easier for end users to manage and pay bills digitally. As innovation continues to flourish, the EBPP landscape is set to transform billing into a more personalized, data-driven, and intelligent process, aligned with the needs of a fast-evolving digital economy.

Top Trending Reports:

AB Testing Software Market-

https://www.marketresearchfuture.com/reports/a-b-testing-software-market-26420

Category Management Software Market-

https://www.marketresearchfuture.com/reports/category-management-software-market-26655

Exit Interview Software Market-

https://www.marketresearchfuture.com/reports/exit-interview-software-market-26453

Supply Chain Risk Management Software Market-

https://www.marketresearchfuture.com/reports/supply-chain-risk-management-software-market-26455

Human Resource Outsourcing Market-

https://www.marketresearchfuture.com/reports/human-resource-outsourcing-market-26694

Next Generation Search Engine Market-

https://www.marketresearchfuture.com/reports/next-generation-search-engine-market-26666

Anti Vibration Mounts Market Size

Automated Industrial Quality Control Market Growth

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Sagar Kadam

Market Research Future

+1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.